Something big is coming soon!

We have some exciting updates on the research platform and we can’t wait to share the news with you!

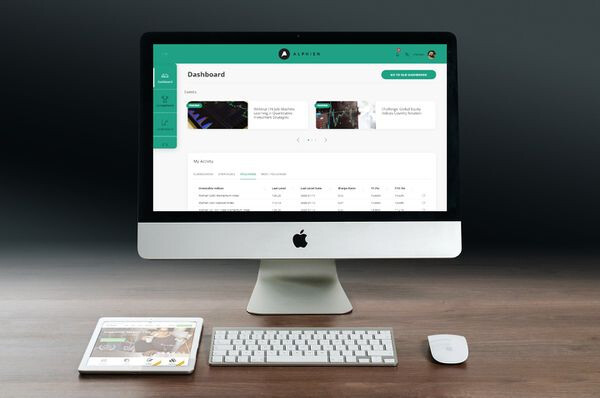

Here’s a sneak peak into the new research platform. We’ve released a brand new look of the user dashboard, currently in an advanced beta testing phase.

The new dashboard promotes:

- Personalization: Users get an overview of their activities (submissions, strategies and followed strategies)

- Relevance: Users are kept up to date with the latest events, blog articles and forum discussions

- Accessibility: A simpler and intuitive interface to allow users to find the right resources easily

Stay tuned for our next announcement this Friday to find out more!

Register to get free access to quantitative research platform

Finalists selected for Asset Allocation Alphathon

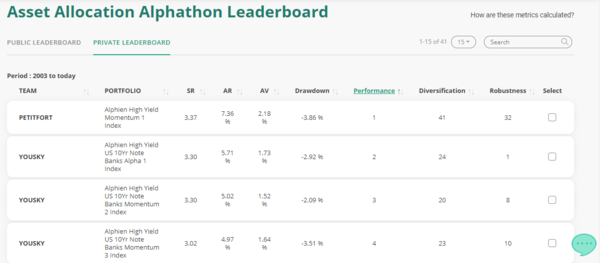

The Asset Allocation Alphathon, sponsored by Decalia and co-sponsored by Lyxor, has officially ended its research phase with 41 strategies validated on the leaderboard.

Leaderboard - Asset Allocation Alphathon

6 teams have been shortlisted as finalists based on the combined scores across performance, diversification and robustness rankings of their strategies.

An interesting mix of profiles amongst them: 4 are professionals in various sectors while 2 are students.

When their algorithms are run with data undisclosed to participants, these strategies have had very low drawdown YTD and 10 out of 12 strategies have better absolute performances YTD compared to the equity market.

To contend for the win, the finalists have been contacted to fine tune their documentations and clean up their codes. Decalia will be selecting the winning strategy based on additional quantitative and qualitative criteria. The winners will be announced in July.

New challenge launched: Global Equity Indices Country Rotation

Following the closure of Asset Allocation Alphathon, we’ve launched a new challenge: Global Equity Indices Country Rotation.

The aim of this challenge is to construct a portfolio that invests in global equity indices. Participants can buy or sell equity index futures across Europe, Asia and America to build a portfolio with the highest returns.

Strategies built for this challenge will be made available for potential strategy licensing by investment managers.

The challenge runs till 22nd July, join now!

Webinar series: Machine learning meets quantitative investing

As we highly encourage the use of machine learning models in the Global Equity Indices challenge, we’ve held a series of webinars on machine learning. The first webinar was held on 1st July, with a focus on feature engineering in financial machine learning. The webinar taught participants how to:

- Integrate financial data in a machine learning model

- Use feature engineering and feature importance ranking to select the most predictive ones

- Make the model learn meaningful patterns without overfitting to create a robust portfolio with high returns

Catch the webinar replays on our YouTube channel:

The second webinar of this series, held on 16 July, focused on integrating machine learning techniques within quantitative investment strategies. Participants learned how to:

- Create a data generator function

- Embed feature engineering within the payout function

- Structure the payout with the ML model

- Retrain the ML model in time at preset intervals

Replays will be made available on YouTube channel very soon. Be sure to subscribe to get notified when we release a new video!

Continue reading: