The Lyxor-X-Alphien Alphathon has officially ended its research phase. The Alphathon now enters its paper trading phase, where submitted portfolios are being placed in simulated trading conditions till the end of February 2020. The final phase of the Alphathon, the jury process and award ceremony, will take place in March 2020.

Some interesting statistics on Alphathon participants

A total of 134 teams have participated in the Alphathon, of which 70% are from the academics and more than 90% are based in Europe. Collectively, participants spent over 500 hours on the platform and 235 submissions (single-asset strategies and portfolios) were attempted by 28 teams.

After validation by our quant team, 57 portfolios (from 21 teams) were approved for the paper trading phase. The most common reason to reject a submission is due to forward looking bias when participants generate trading signals during the in-sample period.

51% of the approved portfolios were constructed according to our recommendation of a double-step process (create market timing signals on individual strategies first, then aggregate the single strategies) while the remaining 49% portfolios were constructed by creating concurrent market timing signals on a basket of securities.

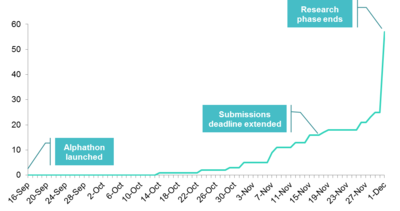

Timely extension of submissions deadline has motivated the Alphathon community to complete their research and finalize their portfolios

Originally planned for the 15th of November, 2019, the end of the Alphathon research phase was pushed back by 2 weeks to the 1st of December, 2019, as many participants signalled they were unable to finish their strategy before the deadline due to ongoing university exams. The community as a whole, including both students and professionals, was able to take advantage of this extra-time to finalise a high number of submissions. Overall, the total number of portfolios submitted to the Alphathon is well above fifty.

Workshops and webcasts proved to be highly effective in boosting portfolio submissions

Throughout the month, we have organised live events in order to help participants with their submissions: we have broadcasted one webcast to explain how to integrate macro indicators in systematic strategies. We have also ran two workshops at Alphien’s office in Paris to describe all tools on the platform that participants could use in order to avoid the classic pitfalls in systematic investing such as forward looking bias. We’re glad to observe that all participants to these events have submitted portfolios to the Alphathon.