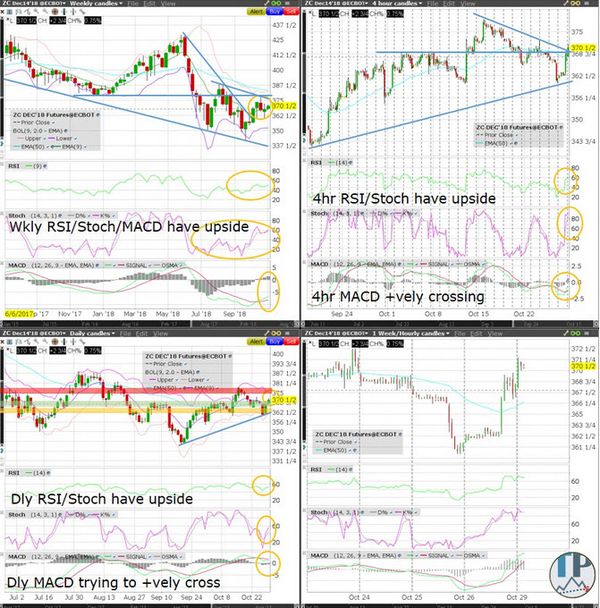

Corn (ZC) Weekly/Daily/4hr

by Darren Chu, CFA of Tradable Patterns / Monday, October 29, 2018

Corn (ZC) is pushing higher in today’s Asia morning continuing the upward momentum that began with Friday’s near 2% rebound. Significantly, last week’s green weekly candle with its long lower shadow after the prior red weekly candle and followed by this week’s green weekly candle forming suggests a higher low. This 3 candlestick pattern resembles a Bullish Island Reversal (although the bullish signal is more reliable with pronounced prior downtrends). Nevertheless, bulls will increasingly return today as ZC breaks above a 2 week downtrend resistance (on the 4hr chart) and appears to want to retest the major horizontal resistance (on the weekly chart) as defined by the January low. The weekly, daily and 4hr RSI, Stochastics and MACD are bottomish, rallying or consolidating recent gains. I am looking at entering long in the green zone (of the daily chart), targeting the red zone by mid week. The amber/yellow zone is where I might place a stop if I was a swing trader (although in my personal account with which I seldom hold overnight I sometimes set my stops tighter).

Credit to: Copyright © 2018 Tradable Patterns Limited, All rights reserved.

About the author

Before the launch of Tradable Patterns , Darren Chu, CFA, served as IntercontinentalExchange | NYSE Liffe’s country manager for Australia, India, and the UAE between July 2010 and January 2014, expanding his role to look after Liffe business development in APAC ex-Japan/Korea until his departure mid April 2014. His primary remit was developing relationships with Liffe clients, prospects and partners in the buyside (traditional and alternative asset managers), proprietary trading (high frequency algo as well as manual, point and click traders), bank, broker (institutional and retail), commodity trader and ISV community. Key futures and options promoted included European/London rate benchmarks such as the Euribor, Short Sterling, Gilts, London/European index futures including the FTSE and CAC, London soft commodities (Robusta Coffee, Cocoa, White Sugar), Paris (MATIF) markets (Milling Wheat, Rapeseed), and NYSE Liffe US markets with the MSCI EM, MSCI EAFE, gold/silver, Eurodollar, US Treasury and GCF Repo futures being the focus.

Previously, Darren was with the TMX Group | Montreal Exchange for 4 years, marketing Canadian futures and options across North America, London, Singapore and Hong Kong. Darren also launched and managed CMC Markets Canada’s Chinese marketing and sales team, along with educational offering. On the academic trail, Darren has been a frequent guest speaker at Canadian universities as well as an author of content for 3 derivatives courses offered by Canadian Securities Institute and mandatory for licensing of Canadian derivatives industry professionals.

Darren can be reached at: +65 8118 8840 or via email at darrenchu@tradablepatterns.com.