Global Macro/Metals:

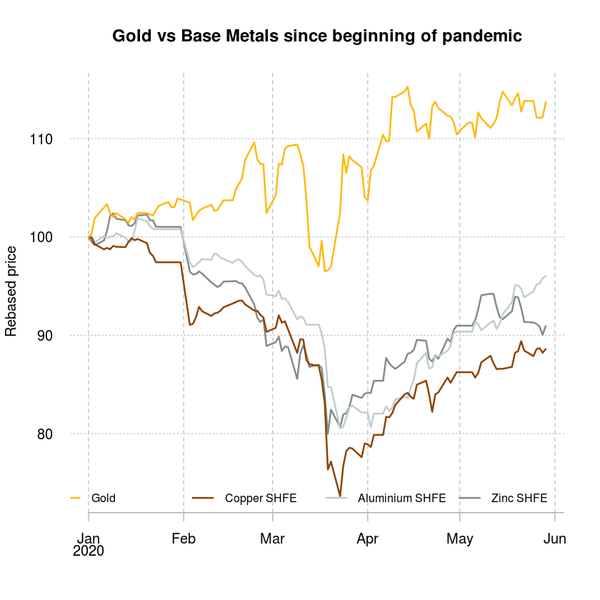

The optimism about the restart of the economy, combined with stimulus in both the US and Europe, is fueling the market with “risk on” recovery on a very short but deep recession cycle (2 months). For long term growth forecasts to be even higher than before the crisis seem unrealistic at this stage, although the short term growth recovery has been fueled by the lack of a second wave in COVID-19 infections as Western economies have begun reopening. The dovish stance of central banks had its full impact in May with velocity of money accelerating, particularly in China. Lower real rates environment is also prompting more investment in gold (ETF inflows were very strong). In the context of deglobalisation and balance sheet expansion of central banks, gold becomes an alternative currency that is not subject to loss in value even if inflation risks remain low in the short term (Gold +3% in May). The mild rebound on the base metal complex still emphasizes the global industrial production situation as demands continue to be weak. Originally, supply cuts were triggered by the COVID-19 situation but many mines haven’t reopened due to low prices.

Energy:

The politicization of the price of oil has increased greatly with the US implications in the Russian-Saudi talk, who has been coming together around what OPEC ministers call the “Pinocchio” problem (also called the “free rider” problem where someone benefits from everyone else’s effort without contributing). Fundamentals have improved tremendously with our petroleum basket (including products and contracts at different locations) up 22% on the month (still down 45% YTD). Inventory draws on WTI (most susceptible to reach stock capacity) have returned back to normal (on a seasonally adjusted basis) but inventories for products (Heating Oil and Gasoline) have increased and inventory overall remains large. The recent agreement to continue cuts for one more month is indeed required and questions the long term commitment of Russia. The focus on getting laggards to increase compliance makes it more difficult for weak economies, especially with the oil price moving up. OPEC will probably target backwardation more than high oil price in order to gain market share and avoid shale oil long term financing (which usually require hedging).

Agriculture:

Sugar prices (+4% in May) were helped by the oil recovery where Brazilian millers reversed their decision to make more sugar than ethanol. Supply concerns over the coronavirus in Brazil, which is currently harvesting the cane crop, created bullish positioning. Arabica Coffee was down 9% on the month (YTD -28%) due to renewed pressure on the Brazilian real and a continued slack demand as a result of continued closure of coffee shops. Live cattle prices also rebounded with rising wholesale prices and strong US beef exports.

Volatility:

Generally speaking volatility was down in May. In the equity sector the recovery in underlying indices continued together with a decline in implied volatility. Although optimism seemed more pronounced in the US than in the EU. The VIX is down from 34.15% to 27.51% on the month while the VSTOXX is down from 33.91% to 31.12%. That being said, the VIX remains at a considerable premium (3.6%) to historical volatility whereas VSTOXX is slightly below realised volatility. In the Agricultural sector, where the underlying prices seem to have found a floor for now, we have also seen some healthy decline in implied volatility. Corn implied volatility was down from 27% to 24% on the month whereas for soybean it was down from 17% to 15%. In the energy sector, a sharp increase in underlying crude prices was accompanied by a sharp correction in implied volatility, down from 164% to 67%. In precious metal, we saw a small increase in silver implied volatility, up from 31% to 34%, a sign of nervousness while the underlying was trying to establish a floor, which it now seems to have. Gold implied volatility was pretty much unchanged, just like its underlying, down from 20% to 19%.

Source: Four Elements Capital