Global Macro/Metals

The recent banking turmoil has caused concerns about the impact on the financial system and the economy, but the near-term stress seems to have subsided. Recent data also points to lower inflation and slower economic growth for the end of the year. Accordingly, the FED’s expected response has been priced to be more dovish with probably only the last 25bp hike increase in May. The impact of high real rates on commodities is crucial to understand this market environment. The return of ‘just-in-time’ inventory and the lack of investor’s appetite in the asset class is slowly shifting the market to be more producer focused (and thus less correlated with equities). Precious metals are expected to play more as a hedge against the potential hard landing as seen during the SVB fallout (Gold +7% in March). In base metals, the reduction of global inventories leave the sector at risk of shocks, particularly with the slow supply elasticity though the deceleration of western manufacturing and trade has also reduced the current demand.

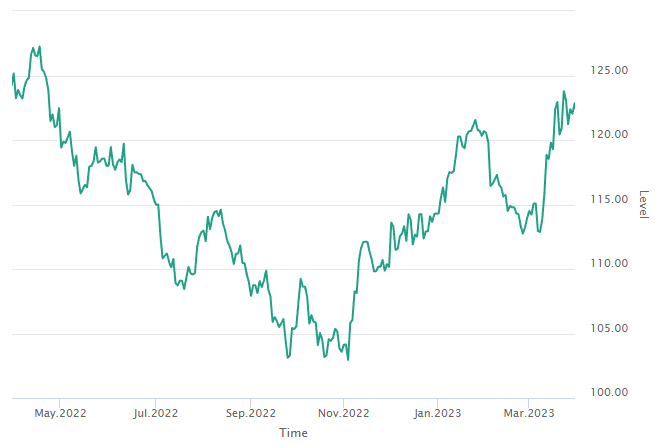

Gold

Energy

Nine members of OPEC+ have announced a “voluntary” collective output cut of 1.66mn b/d to support the stability of the oil market. This cut is consistent with the new OPEC+ doctrine to act preemptively without significant losses in market share. SPR releases in the US and France, and the refusal to refill the US SPR in fiscal year 2023 may have contributed to the OPEC+ decision to cut and keep the price of oil stable. This reduction of inventory increases the tail risk of oil which is skewed on the upside if no hard landing of the economy materializes. Despite colder than seasonally average March, NYMEX gas prices have sold off (NG -15% in March). Natural gas is down 80% YTD and is the only commodity which has accumulated ‘inventory’ for geopolitical reasons.

Agriculture

In March, the grains complex saw an overall increase of 2.9%, but remains down 4.1% year-to-date. Corn gained 4.8% and soybeans rose 1.8%, though wheat dropped by 1.9%. Corn prices initially dropped with stronger exports from Brazil and Ukraine, but rose again as demand from China increased. Wheat prices fluctuated throughout the month caused by uncertainty around the extension of the Black Sea Grain Initiative, and the widening premium seen on hard-red winter (HRW) wheat over the soft-red winter (SRW) wheat due to a drought impacting states growing HRW more than states growing SRW in the US.

Volatility

Volatility increased during the month with the risk of the contamination of bank failure in the US and in Europe, with this risk dissipating, VIX and VStoxx went back to the 20% levels. Volatility on commodities generally decreased.