Global Macro/Metals

The path of digital economy and the traditional industrial economy are diverging, such divergence is impacting commodity demand which is much lesser than expected given the current economic growth. The slowdown in the industrial sector has resulted in reduced demand for commodities, despite overall growth being driven by the technology sector. Manufacturing PMIs have entered contraction territory, and the prospect of continued high rates has further threatens the outlook for industrial metals. In the US, the manufacturing PMI fell to 46.3, while Germany experienced a sharp decline to 40.6, indicating a recession. Although the increase in COMEX copper inventories by 5.7kt (22.5%) to 30.8kt may seem limited in the larger context, it marked its second consecutive month of increase in 2023 is noteworthy. Also, LME inventories in the US surged by 24.2kt (525.5%) in June, while declining in other parts of the world. Base metals had a flat performance in June. Precious metals saw a decline, with gold down approximately 3% in USD terms and 6% in EUR terms. This decline can be attributed to receding fears of inflation and also indications of continued high interest rates.

Energy

In the oil market, demand has continued to surprise on the down side, with all analysts predicting a higher usage of oil over the last few months and is still predicting a market deficit now starting in July. A combination of slower industrial demand, warm weather and destocking has kept the market balanced but, with delay, analysts may be right unless we experience further economic slowness. Petroleum was slightly up on the month and is indeed showing signs for short term deficit through slight inventory draw as seen at the end of the month. On the supply side, OPEC+ made clear its intention to aggressively manage supplies. On 4th June, Saudi Arabia, the world’s biggest crude exporter, announced it will make a further 1mbd voluntary cut starting in July. In parallel, the OPEC+ members that began voluntary cuts on 1st May agreed to extend their production cutbacks to the end of 2024. Quotas have remained almost unchanged, with only the UAE quota set to increase by 0.2mbd next year due to an increase in baseline production. Recent natural gas production increases in the Permian Basin are viewed as excessive and may be revised lower but have kept prices low. US natural gas production reached a record-breaking 103 Bcf on certain days, and has been driven primarily by a sharp rise in Permian volumes following maintenance-related declines in June.

Agriculture

Grain prices experienced volatile swings as the US faced severe drought conditions, impacting the market greatly as it remains a major producer and exporter. US crops are currently in their worst condition since 1988, with drought expanding through June and putting strain on newly planted crops. The US is a significant producer of corn, soybeans, and wheat, and the drought’s effects have raised concerns and big market impact. Despite the challenging conditions, the USDA has not yet revised down its production estimates for the upcoming marketing year. US corn and wheat acreage planted have increased year-on-year, while soybean acreage planted has seen a decline.

Volatility

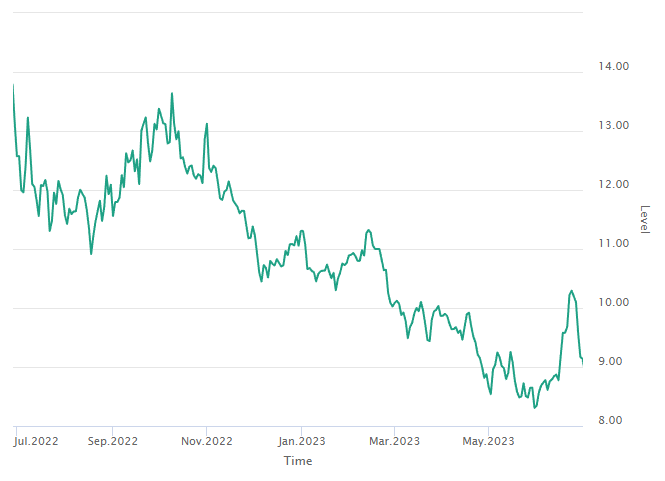

Volatility has come down to a level which doesn’t take into account the geopolitical situation and the risk of continued slowdown in the more traditional economy which could trigger a reversal in the equity market. VIX reached sub -14% level triggering some analysts’ recommendations of cheap downside hedging and overall market consensus that recession is a highly probable outcome in the next 12 months. On the commodity side, WTI volatility also moved down to the 30% levels with an elevated tail risk priced in the strangles. Volatility in the grain market has moved up at the end of the month given the drought conditions.