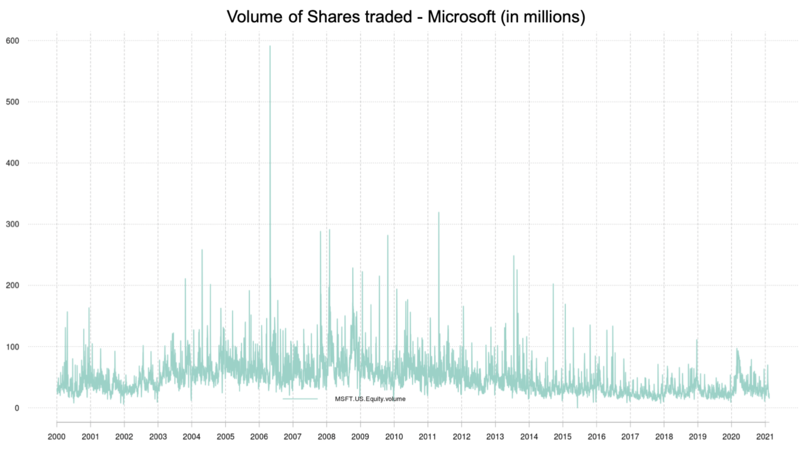

2021 started with an impressive show of the amount of liquidity and high velocity of money available in the markets. Short term rates are expected to remain low for longer as the FED adopts the Average Inflation Targeting (AIT) approach, clarifying that short term rates will go higher only when inflation has crossed the 2% mark. Fiscal stimulus also brings more liquidity and with the broad consensus that vaccination will bring full normalisation, leading to very strong global growth for the year, the market has never priced fundamentals as much as in anticipation as in the current environment. The velocity of money has been also increased by the higher overall volume of trading, a part in which not just institutional but also retail investors have played an increasing role. On the 27th January, the volume of shares traded (U.S. Equity) reached an all time high of 24.5 billion (more than 20% higher than previous high), coinciding with the intraday high of GameStop impacting all commodities and in particular silver which has been subjected to Reddit post instructions in the iShares Silver Trust ETF (Silver moved to an intraday high of more than 11% on the 1st February before falling back). Precious metals have generally been out of favor as optimistic views of the market and the vaccine rollout has depreciated the need for a safe haven. Over the medium term, fiscal stimulus directing the green economy infrastructure will inevitably lead to higher industrial metals production price and increase demand. Although already partially priced in, upside potential remains very important given the estimated ‘green capital expenditure’ of an order of magnitude, over the next 3 to 5 years, of more than 15 bio USD (our reference base metal baskets was up 2.4% in January).

The oil market rebalancing has continued, during the month of January, to beat expectations despite the European lockdowns. This tightening has been driven by both higher demand and lower non-OPEC+ supply. The unexpected Saudi cut, anticipating potential vaccine roll-out delays surprised the market as a change of policy from the Kingdom, allowing Russia to increase production, thus taking a fiscal hit on behalf of others. Liquidity also seems to have moved the market up ahead of fundamentals with a large long positioning of non-commercial players in both the Brent and WTI market. Q1 2020 is expected to have a deficit of 1 mb/d on average through the different market forecast with a consumption of about 94 mb/d (still 6 mb/d less than before the COVID crisis). Natural gas long term fundamentals remain very constructive even if recent warm weather has eliminated the risk of critically low end of winter gas storage.

US 2020/21 production of corn and soybean ending stocks, as per January WASDE report, were below industry expectations and supporting the tightest S/D outlook in the last 6-7 years (Corn was up 13% during the month). The container crisis has affected quite a lot of agricultural commodities, in particular sugar exports from India. China, which has recovered faster from Covid-19, has revved up its export economy and is paying huge premiums for containers, making it far more profitable to send them back empty than to refill them. White sugar surged to a 3 year high (up 8%) as raw sugar price increased at the location of the exporting country (up 2.5%).

Apart from crude and gold where implied volatility is almost unchanged, most sectors saw additional gains in volatility in January. As the liquidity driven bull run across most assets (except for gold) over the past few months keeps pushing prices to new highs, the need for protection against a reversal (puts), as well as the leverage bet that the trend could persist (calls), are driving the demand for options and pushing implied volatility higher for most underlyings. With US equities at an all time high, VIX is up on the month from 22.75% to 33.09% with a peak over 37% and the VSTOXX is up from 23.36% to 29.01%, although both indices are since back to low 20’s. In the precious sector, silver implied volatility is up from 44% to 61% on the month, and even peaked at 76% after that, but went back down to 38%, after Reddit readers tried to squeeze the shorts. In the grains sector, where prices are above 5-year high, corn implied volatility is up from 28% to 37% and soybean’s is up from 26% to 28%.

Source: Four Elements Capital