Global Macro/Metals

Central banks induced growth slowdown in 2022 is expected to last in 2023 and the magnitude of the slowdown will impact commodity prices for the year ahead. Micro fundamentals remain supportive and without a demand destruction, commodities should return to their upward trend. Higher interest rate will support the return to ‘just-in-time’ inventory and more curve in backwardation. For precious metals (gold in particular), rising interest rates and credibility in central banks to continue raising it moved traditional investors away while emerging markets central banks have drastically increased their reserves for geopolitical reasons. Investors may continue to invest if growth deteriorates and interest rates are turning around - that scenario presents the better upside, while a strong growth momentum will make traditional gold investors to focus on other asset classes. Base metals remain in structural deficit for the next few years as their marginal cost of product has been raised by inflationary pressures. China reopening should increase demand even in a mild global slowdown and thus should be constructive in 2023.

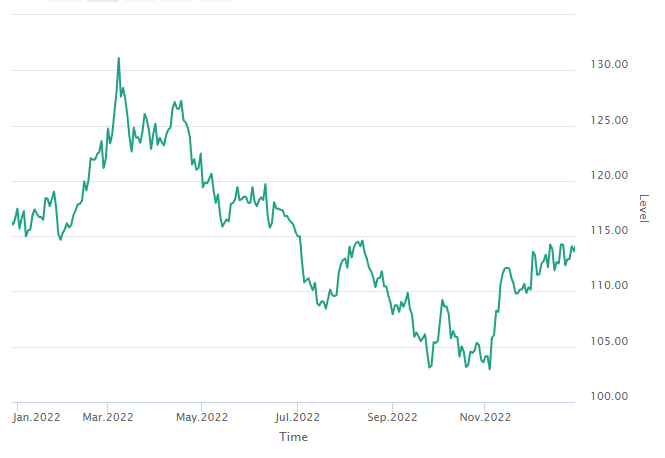

Gold

Energy

The petroleum complex has continued to move down in December against a solid fundamental backdrop and upside geopolitical risk. Warm weather and a reduction of energy usage in Europe has lowered the strong seasonal Q4 demand while Russia’s crude oil production continues. Demand weakness was at the center of October OPEC production cut, which has materialized but is unlikely to follow through as demand (in the current growth scenario) is still expected to increase this year (to about 2.5 mb/d). A soft landing or a gentle recession will still keep the global oil consumption rising and the current correction is likely to be a pause toward higher prices. 2023 European gas balances have increased drastically (seasonally adjusted) thanks to the warm weather. The development of the LNG market has made the international market more related (UK contract was down 66% in December, US Henry Hub contract was down 31%).

Volatility

The central bank shift to a milder interest rate hike and a less volatile commodity demand (with a soft landing expected by market participants) have made the volatility drop rapidly to levels not experienced before. With VIX and VSTOXX below 20%, market expectations of a more range bound market have also been mirrored in the commodity market, even in crude oil where the geopolitical risk (on the upside) has not prevented volatility to fall below 40% (from around 50% one month ago).

Agriculture

On the agricultural side, 2022 has experienced huge volatility and uncertainty and sold off aggressively in the last 2 months to come back to roughly similar levels seen one year ago (before the war). Wheat in particular has seen excellent crop last year and has more than balanced out the Russian geopolitical risk premium which triggered an overshoot on the downside at the end of the year even if Ukrainian export (and production) capacity will be curtailed next year.