China’s financial conditions are loosening in February

This report presents the February 2021 update on the Commodity Leading Index Monetary China (CLIMC, see Appendix for index description).

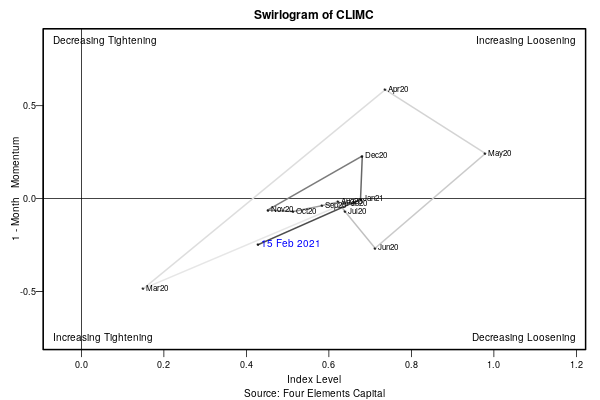

Decreasing Loosening Our CLIMC shows that financial conditions as of mid-February continued to loosen but at a slower pace than in January. Consumer inflation in January fell 0.3% yoy, due to reduced consumer demand as a result of lockdowns in norther China in response to new Covid-19 outbreaks. Producer inflation rose 0.3% yoy, driven by increases in upstream raw materials. RMB depreciated against the basket of currencies of main trade partners. Correspondingly, as shown in the Swirlogram, the CLIMC places the financial environment in an decreasing loosening mode. The monthly index average of 0.43 is down by 0.25 over the month (one year range is 0.15 to 0.98) and is below the yearly average of 0.6.

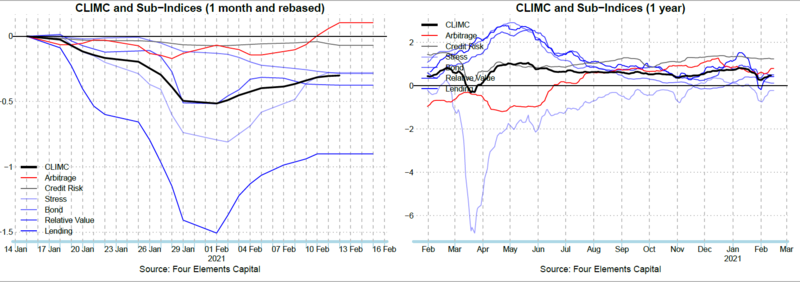

CLIMC and Sub-Indices Over the previous month, 1 sub-indices of the CLIMC increased, 1 sub-indices remained within the month-on-month momentum range of +/-0.1 standard deviations (s.d.) while 4 decreased. On the positive side, the Arbitrage sub-index increased due to widening margins on RMB arbitrage transactions. On the negative side, the Lending, Relative Value, Bond and Stress sub-indices decreased due to increasing interbank rates, deteriorating liquidity conditions in the banking sector, increasing (government) bond yields, and increasing market volatility respectively.

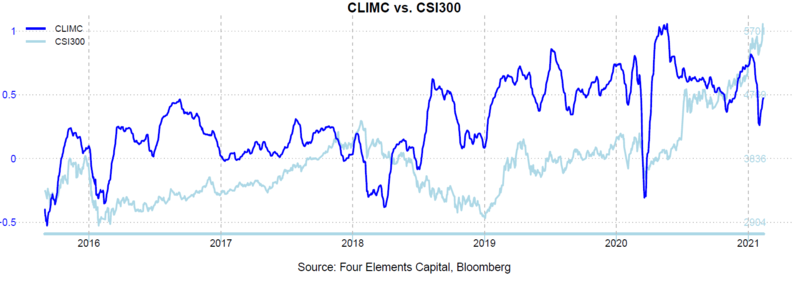

CLIMC vs. CSI300 The CLIMC correctly captured the major turning points in Chinese equity as measured by the CSI300 during the recent months. The improvement of the index in mid February 2016 has bolstered the markets in March 2016. The improved financial conditions which started in late June 2016 has led to the upward movement of the markets in August 2016. In addition, the weakening financial conditions since November has pointed to the end of the equity rebound in December 2016. The equity market then benefited from relatively loose financial conditions during the first three quarters of 2017. The tightening conditions that prevailed during the last quarter of 2017 and early 2018 weighted on the equity market. The acceleration of loosening conditions only began to support the equity market in 2019. Loosening financial conditions starting in April 2020 supported the equity market in the aftermath of the coronavirus, as shown in the graph below.

Disclaimer This material is solely for your information and use. It is not a solicitation or an offer to participate in any trading strategy. Investors should rely solely on fund documents in making investment decisions. This material does not constitute or form part of, and should not be construed as, any over for sale or subscription of, or any invitation to offer to buy or subscribe for, any investments, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FOUR ELEMENTS expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) the use of this note, (ii) reliance on any information contained herein, (iii) any error, omission or inaccuracy in any such information. The price and value of investments mentioned and any income which might accrue may fluctuate and may fall or rise. Past performance is not necessarily a guide to future performance. This information and any related recommendations or strategies may not be suitable for you; it is recommended that you consult an independent investment advisor if you are in any doubt about any investments or investment services. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. If an investment is denominated in a currency other than your base currency, changes in the rate of exchange may have an adverse effect on value, price or income. The levels and basis of taxation may also change from time to time.

Source: Four Elements Capital