September 2022 CLIEAC indicates economic Contraction in China

This report presents the September 2022 update on the Commodity Leading Index Economic Activity China (CLIEAC, see Appendix for index description).

Contraction As indicated by our CLIEAC, the Chinese economy is in contraction mode. Manufacturing conditions are slightly worsening (Caixin/Markit PMI fell from 50.4 to 49.5; NBSC PMI rose from 49.0 to 49.4), amid weakening demand, while power shortages and COVID outbreaks disrupted production. August trade data exports fell to +7.1%, as rising interest rates and geopolitical tensions pummel external demand, while imports fell to +0.3%, crippled by extreme heatwaves, the property crisis and sluggish consumption. RMB is depreciating against the basket of currencies of main trade partner.

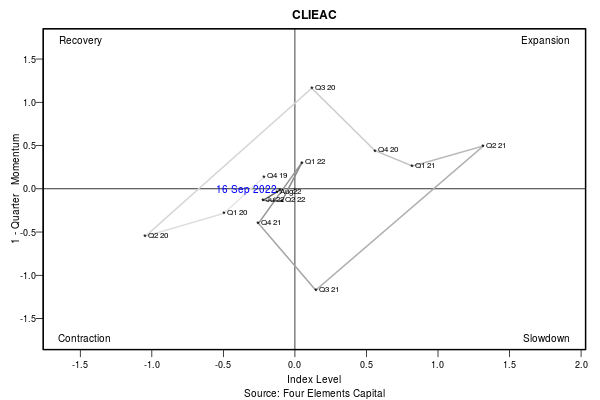

Correspondingly, as shown in the Swirlogram, the CLIEAC places overall economic activity in contraction mode. The monthly index average moved by 0.04 over the month to 0 (one year range is -0.64 to 0.37). The current quarter average of -0.11 is below the previous quarter average of -0.09 and below the yearly average of -0.1.

Note: The values of the previous quarters reflect the index average for the entire quarter. The values of the current quarter reflect the index average for the current quarter up to the date of the report release.

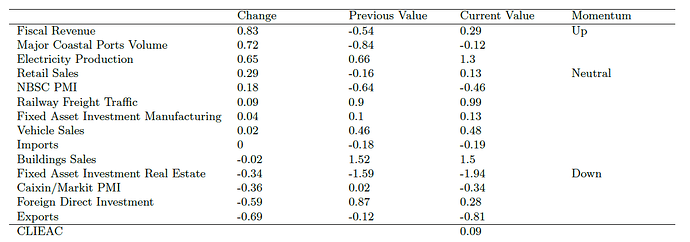

CLIEAC Components Over the previous period 3 components of the CLIEAC increased, 7 remained within the momentum range of +/-0.3 standard deviations (s.d) and 4 decreased. More than half of the components (08 out of 14) remain above their long-run average of zero.

On the positive side, the Fiscal Revenue experienced the largest increase of +0.83 s.d., followed by Major Coastal Ports Volume and Electricity Production.

On the negative side, Exports exhibited the largest drop of -0.69 s.d., followed by Foreign Direct Investment and Caixin/Markit PMI.

Disclaimer This material is solely for your information and use. It is not a solicitation or an offer to participate in any trading strategy. Investors should rely solely on fund documents in making investment decisions. This material does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any investments, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FOUR ELEMENTS expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) the use of this note, (ii) reliance on any information contained herein, (iii) any error, omission or inaccuracy in any such information. The price and value of investments mentioned and any income which might accrue may fluctuate and may fall or rise. Past performance is not necessarily a guide to future performance. This information and any related recommendations or strategies may not be suitable for you; it is recommended that you consult an independent investment advisor if you are in any doubt about any investments or investment services. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. If an investment is denominated in a currency other than your base currency, changes in the rate of exchange may have an adverse effect on value, price or income. The levels and basis of taxation may also change from time to time.

Appendix: Index Composition The Commodity Leading Index Economic Activity China (CLIEAC) is a composite index that provides a measure of overall economic activity in China. The index consists of a equally weighted basket of components which reflect fundamental data related to economic activity. Each index component is Chinese New Year calendar effect-, trend- and seasonally adjusted, smoothed, normalized and updated in the index as new data becomes available. The rolling standard score (Zscore) approach is applied to normalize each component before aggregation. As such, a reading above zero indicates expansion and below zero contraction of economic activity relative to the long-run average. Upwards and downwards movements of the index indicate improving and deteriorating economic activity respectively. The CLIEAC is composed of 14 components covering supply- and demand- side factors across five categories.

- Production: Electricity Production, Fiscal Revenue, Caixin/Markit and NBSC Purchasing Manager Index

- Transportation: Port Freight Traffic, Railway Freight Traffic

- Trade: Total Imports, Total Exports

- Consumption: Retail Sales, Real Estate Sales, Vehicle Sales

- Investments: Fixed Assets Investment Real Estate and Manufacturing, Foreign Direct Investments