February 2021 CLIEAC indicates economic expansion in China

This report presents the February 2021 update on the Commodity Leading Index Economic Activity China (CLIEAC, see Appendix for index description).

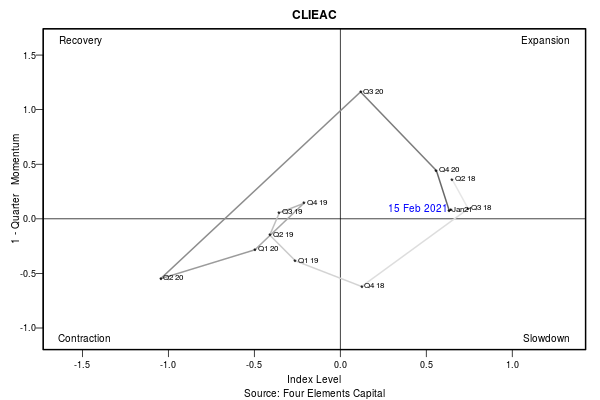

Expansion As indicated by our CLIEAC, the Chinese economy remained in expansion mode. Manufacturing conditions worsened, as reflected by the PMI figures (Caixin/Markit PMI down from 53.0 to 51.5; NBSC PMI down from 51.9 to 51.3), due to lockdown measures imposed over a recent Coronavirus resurgence. There is no trade data released for January to remove the seasonal influence of the Lunar New Year holiday. RMB depreciated against the basket of currencies of main trade partners over the month. Correspondingly, as shown in the Swirlogram, the CLIEAC places overall economic activity in an Expansionary mode. The monthly index average moved by 0.05 over the month to 0.68 (one year range is -1.31 to 0.7). The current quarter average of 0.64 is above the previous quarter average of 0.56 and above the yearly average of -0.11.

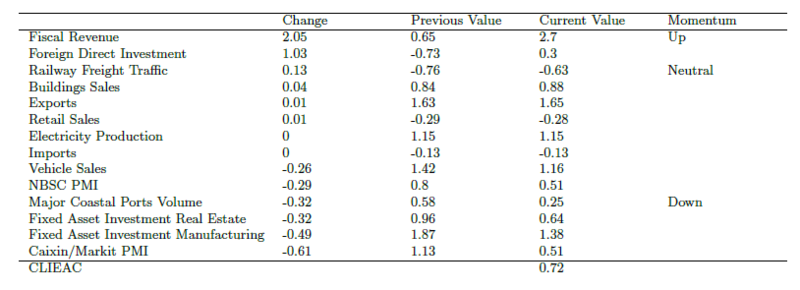

CLIEAC Components Over the previous period 2 components of the CLIEAC increased, 8 remained within the momentum range of +/-0.3 standard deviations (s.d) and 4 decreased. More than half the components (11 out of 14) remain above their long-run average of zero. On the positive side, Fiscal Revenue experienced the largest increase of +2.05 s.d, followed by Foreign Direct Investment. On the negative side, Caixin/Markit PMI exhibited the largest drop of -0.61 s.d, followed by Fixed Asset Investment Manufacturing and Fixed Asset Investment Real Estate.

Disclaimer This material is solely for your information and use. It is not a solicitation or an offer to participate in any trading strategy. Investors should rely solely on fund documents in making investment decisions. This material does not constitute or form part of, and should not be construed as, any over for sale or subscription of, or any invitation to offer to buy or subscribe for, any investments, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. FOUR ELEMENTS expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) the use of this note, (ii) reliance on any information contained herein, (iii) any error, omission or inaccuracy in any such information. The price and value of investments mentioned and any income which might accrue may fluctuate and may fall or rise. Past performance is not necessarily a guide to future performance. This information and any related recommendations or strategies may not be suitable for you; it is recommended that you consult an independent investment advisor if you are in any doubt about any investments or investment services. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. If an investment is denominated in a currency other than your base currency, changes in the rate of exchange may have an adverse effect on value, price or income. The levels and basis of taxation may also change from time to time.

Source: Four Elements Capital