Global Macro/Metals

The economy appears to be on track for a soft landing, with inflation normalizing and non-recessionary growth accompanied by lower unit labor costs. This provides some flexibility for central banks. Across various sectors, there has been a retracement in commodity prices, contributing to this normalization trend, which has continued in May. The velocity of money remains strong, supported by positive news regarding subsidies, budgetary measures, and government support in China1. However, the weakness observed in the base metal sector (often seen as a leading indicator of industrial activity) raises concerns about the impact of a higher interest rate environment on the property sector and manufacturing demand. Copper experienced a 6% decline in May, following a rebound towards the end of the month. Precious metals also retraced, with gold declining by 2% in May, reflecting reduced risk of a severe economic downturn and easing inflationary pressures.

Natural Gas

Energy

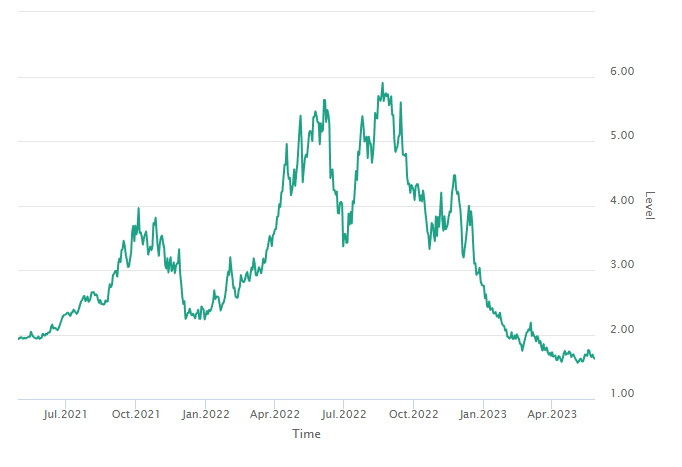

In the petroleum complex, oil prices declined by 9% during the month. This goes against the fundamental reading of the market, as overall inventory and positioning continue to decrease, exerting downward pressure on prices. Despite Saudi Arabia’s recent “unilateral extendible” output cut of 1 million barrels per day, the market reacted positively only for a short period. On the supply side, both Russia and Iran have increased production, adding to the bearish price pressure. Slower economic growth and weaker demand have given producers an opportunity to ramp up production at current price levels. Additionally, natural gas demand was lower than expected due to warmer weather conditions, leading to a 12% decrease in price (year-to-date decline of 55%).

Agriculture

In May, the grains complex experienced a drop of 2.8%, primarily driven by significant declines in soybeans (-8.4%) and wheat (-6.2%), while corn managed a modest gain of 0.5%. The year-to-date performance of the grains sector shows a decline of 13.6%, with wheat standing out with a loss of 27%. The decline in wheat prices was influenced by drought conditions affecting states growing Kansas wheat more severely than those growing Chicago wheat. On the other hand, soybean prices fell throughout May, influenced by higher-than-expected projected ending stock numbers for the upcoming season. Corn prices initially decreased up to mid-May but later rebounded, affected by the renewal of the Black Sea Grain Initiative, which allowed Ukraine to continue exporting crops for an additional two months.

Volatility

In this well-controlled inflation normalization process, it is not surprising to witness a decline in volatility, as evidenced by the VIX and VSTOXX reaching around 15% level. However, it is important to note that this drop in volatility seems to be fully priced in, considering the context of tightening credit situations and ongoing geopolitical tensions. In the volatility market, structured product manufacturers recognize the value of promoting capital guaranteed products, which offer attractive upside potential with minimal downside risk, particularly in a high-interest-rate environment. On the commodity side, historically, low inventory levels have been associated with a high level of volatility of volatility (vol of vol), as the limited buffer allows any supply changes to have a significant impact on prices.

1 Read our latest report to our proprietary index on Commodity Leading Index Economic Activity China and Commodity Leading Index Monetary China