Did you know Alphien is the start-up most innovative of 2020?

On October 13th, 500 professionals of the asset management industry gathered in the 11th edition of the AM Tech Day, organized by L’AGEFI. That day is the European market yearly event dedicated to analyze the impact of technological innovation on the business models, client relationships and organizations in the asset management industry.

The given awards were for “the best customer experience”, “the most innovative technological solution”, “the most innovative business solution”, “the most sustainable initiative” and only one was reserved for start-ups: “the most innovative start-up of 2020”, which Alphien won.

We have the winners of the USD 20,000!

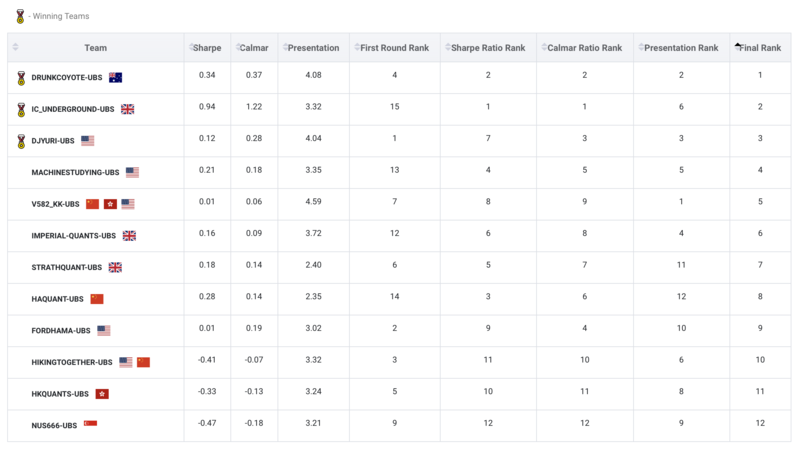

The UBS Quant Hackathon 2020 has come to an end! After 4 weeks of intense competition between 371 teams and 2,559 students around the world, 339 excellent strategy submissions with impressive results were reviewed and 15 teams were selected to participate in the final round!

The topic for the 3 day live hackathon was Enhanced FX strategy (check details of the challenge here), for which the participants had to build a diversified currency trading strategy, taking advantage of interest rates spreads between currencies, while controlling the volatility of the FX portfolio.

The participants had the chance to build their strategies together with the UBS Quant experts, as each team was assigned a mentor, and they presented the final results in early November.

We have the winning strategies of the Decalia-Lyxor Alphathon!

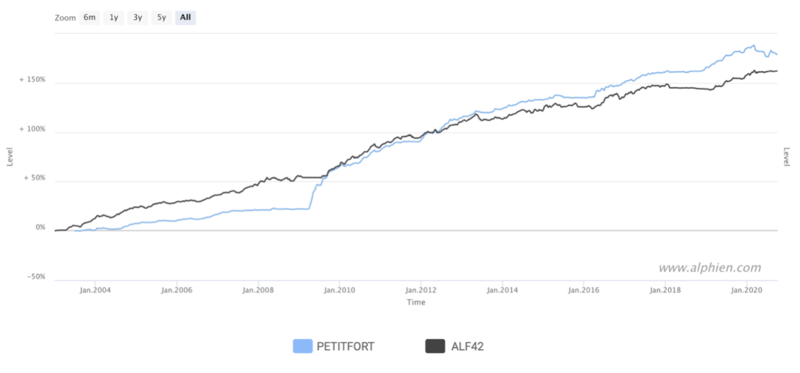

In May 2020, Alphien, Decalia and Lyxor launched the Alphathon, which was aimed at building a dynamic long-only allocation strategy between US Treasury bonds, US High Yield bonds and European banking stocks. The three assets have been chosen for their complementarity throughout the economic cycle and in different market regimes.

106 teams registered for the competition and 41 strategies were submitted and validated by Alphien’s Quant team. A large number of solutions had brilliant performances and the results were analysed in-depth and multiple criteria were taken into account to select the best strategies: their Sharpe ratios, maximum drawdowns, the sustainability of performances through time, portfolios’ turnover, the diversification of the allocations and the models’ robustness.

Congratulations to ALF42 and PETITFORT for building the winning solutions Alphien Cross Asset XGBoost Index and Alphien High Yield Banks US 10Yr Note Beta 1 Index! Evaluated over a period of 10 years running from the end of 2009 to the end of 20219, these strategies delivered average annual returns of +3.94% and +3.87%, Sharpe Ratios of 1.61 and 2.37 and Maximum Drawdowns of -3.54% and -2.86% respectively. All strategies were also evaluated using an out-of-sample set of data and these two came out as the best performing and most replicable solutions. They are now paper replicated (i.e. their performances are calculated each day in real market conditions) since 1 June 2020.

The co-winners will receive a cash prize of €9,000 each and since the sponsor will launch a fund for at least 10 Mio USD with one of the strategies, one of the winners will receive 5bp per annum and all assets that will be licensed under their strategy and as long as the product exists.