In this article, I’ll introduce Alphien, a fintech that offers free access - for non-professional quantitative researchers - to curated financial data and a strategy building pipeline. Thanks to the Alphien platform, you can design a robust systematic strategy in only a few lines of code, no need to be a financial expert.

Who is Alphien for ?

Alphien’s objective is to open access to data and tools used by professional quantitative researchers. Whether you are a data scientist, a physicist, a mathematician, an IT professional, a student or just a finance aficionado, you can use Alphien if you know how to write some code (and if you understand the code you write… Explicit is better than implicit, right?).

Why use Alphien?

Whether you’re a finance professional or not, searching, validating and pre-processing financial data is both challenging and time consuming. Outside of a financial organisation, you might also lack the tools to build your strategies, test their performance and systematically monitor them for common biases. You may also be unfamiliar with the systematic approach: testing for an investment logic in the past is only part of the puzzle; your algorithm also ought to apply to future data, and its performance has to generalise. Alphien endeavours to fill this gap by giving access to all the tips, methods and tools finance professionals use when they build strategies. When your strategy is submitted to us, we vet it and it then runs daily on new market data. Vetting a systematic strategy is not a trivial operation: we first make sure the algorithm logic is correct, that it doesn’t suffer any biases and that it can be replicated. We also securely host it on our private cloud, ensuring your intellectual property is protected. With Alphien, you are basically running your own systematic investments firm without the need to open one, which is a very costly and time-intensive process.

What’s to gain?

The platform centralises tools to build investment strategies, but what’s to gain for users?

Firstly, Alphien organises research competitions - which we call Alphathons. Alphathons are sponsored by asset management companies and tackle concrete challenges they face. Winners typically earn a cash prize. In addition, their strategies have a high chance of being licensed, which is to say replicated, by an asset manager. We’re currently holding an Asset Allocation Alphathon where the winning team will collect €18,000 and have €10 million invested in its strategy. New joiners are welcome. Secondly, you have guessed it, users’ strategies can be licensed by asset managers. While this happens, the user still enjoys the intellectual property of his/her algorithm and collects the attached licensing fees. The algorithm is not sold to our clients; we give them a way to replicate the strategy, as if it were an index. No need to take part in an Alphathon to benefit from licensing, just submit your strategy and we’ll market it to asset managers.

What’s available on the platform?

Here is a list of tools we have put together for our users:

- AlphienStudio: IDE based on R-studio that embeds financial data and libraries.

- Notebooks: popular tool to code and document research. Notebooks run with R kernels on the platform.

- Qlib: function centre where you can store personal or team functions, access public function documentation and source code. There is also a version control engine in it.

- Wiki: knowledge centre that gathers in-depth documentation about how to use the platform and how to build strategies. Feel free to contribute.

- Forum: place to discuss ideas, report issues, look for team mates, basically anything that calls an answer. The more threads, the merrier.

- AlphaChat: chat engine connecting all Alphien users. You can directly talk to our quant dev team there. Cherry on the cake, there is an embedded video/call feature if video or voice is your favourite communication means.

As per data, the basic Alphien account grants you access to all adjusted price series (we call them building blocks) of futures contracts on major stock indices, currencies and commodities. We have plenty of extra series, from single stocks’ prices and fundamental metrics to economic indices. However, you will need to unlock these features to access them.

Enough talking the talk, please show me some code!

By now, I hope you can see the benefits of using Alphien. Yet, if you’re not used to writing financial algorithms, you may still wonder if it is really for you? We think it is. I’ll show you the basic way of creating a systematic strategy on the platform.

Let’s head to the AlphienStudio. The first step is to run:

.sourceQlib()

This will load all quantitative libraries you need to get started. If you use notebooks, the .sourceQlib() function also needs to be called first to load all functions in your environment.

Now, let’s create a simple strategy, the “hello world!” of quantitative finance: the moving average cross strategy (you can just look for it in your favourite search engine). You can create a strategy object by calling algoEngine(). We’ll follow these four steps:

- Create the strategy object by passing in the asset name in which you want to invest. I’ll use the SP 500 e-mini futures (“ES”).

- Apply a payout function to the algoEngine, i.e. the function that defines the investment logic to buy/sell the underlying asset. We attach the payout function to the algoEngine with the payout() method. I’ll use the emaCross payout, which is an existing payout on the platform. We can pass in extra arguments to the payout() method after the payout name (see below “px”, “short”, “long”).

- Evaluate the strategy by calling the evaluate() method of our algoEngine.

- Call the backtest() method to see the results.

Fortunately, these four steps take four lines of code.

style=“text-align: justify;”algoEngine(“ES”,type = “MM”) %% payout(emaCross,px=getBB(“ES”), short=40, long=260) %% evaluate() %% backtest()

This is the backbone of Alphien’s strategy pipeline. As simple as it may look, there is plenty of leeway to add complexity to the strategy. Yet, the only thing you need to modify is the payout function (here “emaCross”). You can use existing payouts that are available on the platform and compose them, or create your own.

Let’s take a look at the output of our strategy:

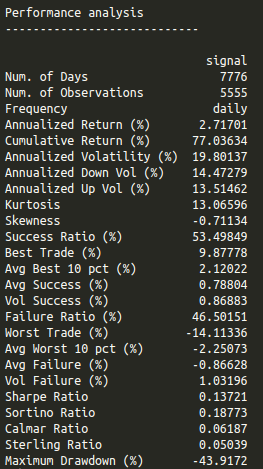

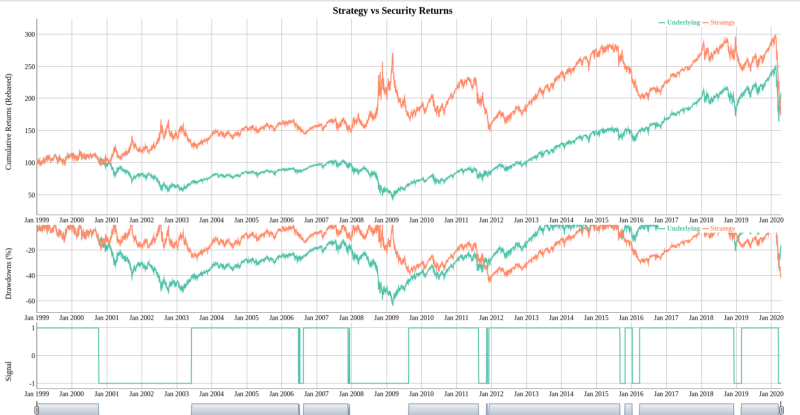

Performance and strategy analytics

Visual output of the backtest

With these four lines, you have created a systematic strategy: its life doesn’t end at the end of the backtest. When you submit your strategy to us, we’ll run it daily on new market data and it will raise the corresponding buy and sell signals. Of course, I’ve just unveiled a tiny part of what you can achieve through Alphien. However, the heavy lifting only consists in mastering this strategy building pipeline. Once this is done, you’ll be able to create and test strategies in no time. When satisfied with performance, submit it and Alphien handles the rest.

Stay posted for more articles where we’ll dig into detailed strategy examples. In the meantime, I hope to see you join us on the platform!

Written by: Hervé - Chief Quantlab Officer @ Alphien