Global Macro/Metals

The recent rebalancing of the US labor market appears to be consistent with a gradual and controlled deceleration of the global economy, even if the latest CPI and unemployment numbers surprised on the upside last month. With these latest numbers central banks generally continued on their tightening path with both the ECB and the FED hiking by 75 bps, building their credibility that they will fight inflation and thus impacting gold negatively. Gold was down 3% in EUR terms, as EUR stayed strong against the USD. Gold price remained above 1600 probably due to the Central Bank’s purchase of bullion, nearly 400 tons in Q3, as reported by the World Gold Council (making the YTD purchase of gold by central banks the highest since 1967). Such participation by central banks is a game changer for the market as the demand for a politically neutral reserve asset increases in a geopolitically bipolarized world order. These flows balanced the ETFs outflows from investors, which puts gold underinvested. More recently, the FED hinting at slowing down the pace of rate hikes was also seen as constructive for the complex. The fear of recession and China’s Covid-19 policy remain the drivers of base metals prices, overwriting the supply situation (low inventory and supply tightness). The sector was down on average 2.5% for the month.

Energy

The expected global demand of petroleum improved during the month as the fear of a recession recedes and China’s zero-Covid policy should be progressively ending within the next few quarters. Brent oil was up 10% in October. Continued discussions about the G-7 oil price cap remain a risk bias for the upside. Russian discounts to market price is estimated to be around $5-10/bbl due to strained freight markets and the difficulty to redirect its oil to the east. The risks of Russia retaliation could further stress the price on the upside. The additional bullish event of last month was the OPEC+’s surprise cut of 2mb/d on October 5th which was followed by a White House FACT SHEET1 to incentivize US production. The strategy of buying time ahead of the elections has worked successfully and maintained oil at low levels but the pressure is mounting as the market is tightening. US producers tend to hedge 12-18 months forward and reducing their hedge could put additional pressure on the front end spreads.

Agriculture

Uncertainties about the Russian-Ukraine grain agreement have pushed the price of grains (wheat in particular) slightly up at the end of the month after the much better than anticipated export season was terminated (Russia benefited from this agreement as much as Ukraine and exported their grains). In the US, the surprisingly low water level in the Mississippi river raised concerns about US exports pushing prices down (as the inability to transport has oversupplied the US market). Cotton had better supplies and weaker Chinese and Indian demand (down 15% on the month).

Wheat

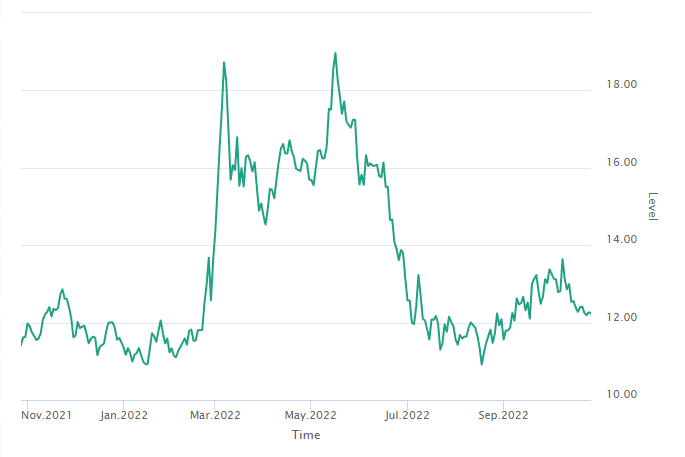

Volatility

Volatility across the board dropped significantly due to the lower risk of a sharp and drastic recession in both US and Europe (VIX and VSTOXX dropped about 10% to the low teens level). Crude oil volatility also dropped with the White House defacto ranging the market at these levels given their announcement to start filling up SPR reserves around $70/bbl.

1 Read the White House FACT SHEET on incentivizing US production here