Global Macro/Metals

Central banks seem to have won the first battle against rising inflation. Jobs-workers gaps, the key indicator for the FED policy stance1, has continued to improve, lowering expectations of spiraling wage growth. Commodities (and particularly Energy prices) have also contributed to lowering inflation expectations with an ongoing correction over the last few months. The market has been quick to price in this ‘pivot’ with a slower projection of rate increase and an anticipation that the FED will react promptly to avoid a recession. For 2023, even if the prediction of a controlled slow down and a stabilization of commodity prices remain the markets’ most likely scenario, the balance remains very fragile with high risks justifying the increasing negative carry of holding gold (up 6% in Nov, down 6% YTD). As traditional gold investors have continued to shy away from it due to higher rates and lower than expected inflation, emerging market central banks demand is creating a new flow that has taken the market off guard. The FED’s ability to pivot quickly has also reassured gold investors that in case of a recession (and a slump of the equity market), the FED will be quick to adjust monetary policy.

Energy

On the petroleum front, the impact of the G7 price cap has been surprisingly bearish. A higher cap at 60 USD/bbl has reduced the incentive for Russia (and global consumers) to evade the cap. Such an adoption from market participants, even at a high price (Russian oil has been trading at a discounted price since the beginning of the war), would shift the balance of price control more to the consumers at the detriment of OPEC. As long as Russia doesn’t respond by a cut of production, the global market would not be affected by less crude but only Russian oil will be selling at a lower price (a Russian shadow fleet of vessels recently acquired that don’t require G7 insurance is being made available for exports). On the other hand, with the end of the SPR release and the continued increase of oil demand (e.g. zero covid exit from China) may open more upside for oil in 2023. The real test of the mechanism is if prices go higher again, so that Russia’s retaliation (by cutting production) may have a bigger impact on the market while still benefiting from higher prices (and hence has the financial power to cut production).

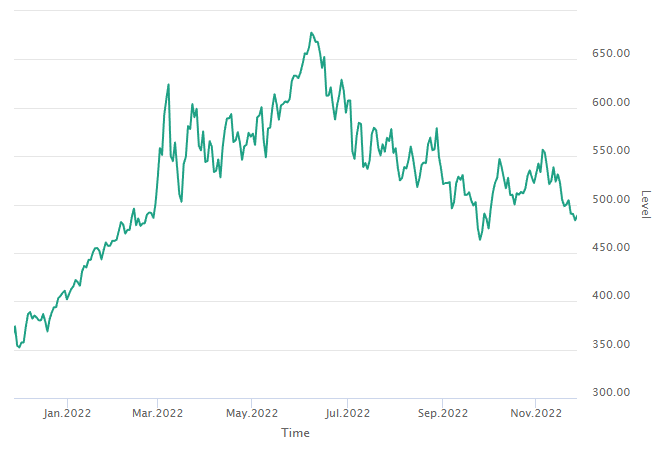

Crude

Volatility

Volatility moved lower as the likelihood of a controlled economic slowdown increased investor appetite for risky assets and the equity market (among others) moved up. As short term risks are low, medium term risks remain high and are shown in the curve structure of volatility where longer dated vol is now higher than the short term volatility. VIX and VSTOXX moved down by 20% in November, volatility also decreased on the commodity complex (gold, corn and soybean) but remained somewhat elevated (at around 50) for crude oil due to the big tail risk on petroleum.

Agriculture

The Agricultural market is becoming less geopolitical and continued its bearish realignment to a more fundamental price, At the end of the month (and as a sign of stabilization of price) South American weather concerns and better demand prospect from China have favored prices and flows in the complex.

1 Read the FED speech on the 30th November here