Global Macro/Metals

The anticipated conclusion of the hiking cycle due to lower inflation, as indicated by recent data, has initiated a turnaround in commodity prices. Notably, the base metals complex, which had been affected by the slowdown in global industrial activity since the start of the year, has experienced a rebound, with major metals such as nickel, zinc, copper, and aluminum seeing gains ranging from 5% to 10%. Despite predictions of a slightly reduced growth in China, the announcement of a stimulus package by the Chinese government has provided support. It’s worth noting that China’s financial conditions remain somewhat tight at the moment. If there is an acceleration in global growth, it is likely to impose additional upward pressures on these markets. Gold rose modestly on the month with the expectation of lower interest rates for next year, ETF holdings decreased showing the lack of investment interest.

Energy

In the petroleum sector, elevated funding rates have persistently contributed to inventory depletion. The heightened demand on gasoline and heating oil has placed pressure on refining margins due to faster product consumption compared to the capacity provided by refineries. The announcement from Saudi Arabia regarding the extension of its voluntary 1 million barrels per day cut until August exacerbated the situation on the supply side, resulting in a reversal of the previous downward trends in crude oil prices. The US Department of Energy reported a substantial decline in inventories, further indicating the tightness in the market. Meanwhile, natural gas prices continued to decline over the month due to the seasonal pattern of usage and cooler temperatures.

Agriculture

The grain complex underwent significant fluctuations over the month, witnessing a substantial surge when Russia announced its withdrawal from the Black Sea Grain Initiative. The subsequent attack on Reni, one of the largest ports on the Danube river, further impacted the market dynamics. Towards the end of the month, weather data related to the US crop and the broader harvest provided a degree of relief to the market. Meanwhile, cocoa prices continued their upward momentum in July, driven by a smaller-than-usual harvest currently taking place in Ivory Coast, compounded by heavy rainfall.

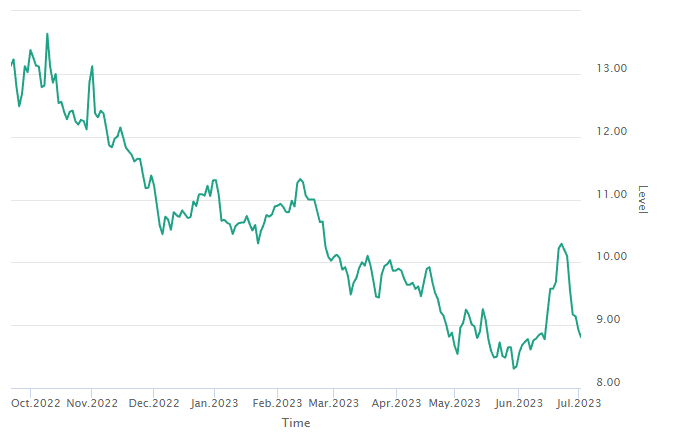

Volatility

Volatility persisted in a risk-off environment throughout the entire month. The anticipated conclusion of the rate hike cycle had already been factored into the market during the previous month. In contrast, the equity market appeared to relinquish some of its earlier gains, with both VIX and VSTOXX moving back up from its 14% lows and now stabilizing around the 16-18% range. The recent upswing in commodity prices is likely to exert upward pressure on commodity volatility once again. This volatility remains elevated, reflecting both geopolitical tail risks and the constrained inventory environment, even though the market is balanced at this level.