Global Macro/Metals

Despite bullish fundamentals, precious metals are experiencing bearish price action due to the inverse correlation between positive news and market sentiment. The anticipation of prolonged rate hikes by the Fed to combat inflation is the dominant factor driving bearish expectations of future price movements. Recent growth and inflation data caused the Fed to shift from a more dovish stance to a position that suggests the terminal funds rate is likely to be higher than previously predicted. While inflation typically supports precious metals, market belief in the determination of central banks (especially the Fed) has caused metal prices to decline by nearly 6% over the month. Industrial metals are also experiencing a flat year after a strong rise in January, which can be attributed to anticipation of further rate hikes in Europe and the US and a slowing down of overall global growth. However, fundamentals remain supportive, and micro data suggests that certain metals are tightening. Even in a lower growth environment, the demand for “green” related metals is expected to continue due to global subsidies.

Energy

The oil market has experienced a recent downturn due to weaker-than-expected demand and higher-than-forecasted supply. Given the low inventory environment, the oil market is even more sensitive to change and making the market less expectant. In the developed economies, the trend to lower demand by unit of growth will probably be exacerbated by continued government subsidies that promote the use of renewable energy sources over traditional fossil fuels; peak demand has probably been reached in US and Europe given that growth and inflation will be capped by central bank policies. OECD demand is predicted to be reduced given the growth forecast to be -0.5 mb/day. Although non-OECD demand for oil is expected to keep on expanding, the overall structural shift towards renewable energy has continued to weigh on prices. In addition, unseasonably warm weather has led to decreased demand for heating, further contributing to the recent drop in oil prices. Meanwhile, natural gas prices have also been affected by the mild winter, with Henry Hub front contracts trading close to 2$/MMBTU compared to a high of around 10$/MMBTU in August.

Agriculture

On the grain complex, despite fundamentals being better than expected, forecasts of a strong supply from the Black Sea for the next harvest have put pressure on wheat prices, causing a decline of 8.5%. However, it’s worth noting that corn and soybean have held up relatively well in comparison, even though they were down on the month as well.

Wheat

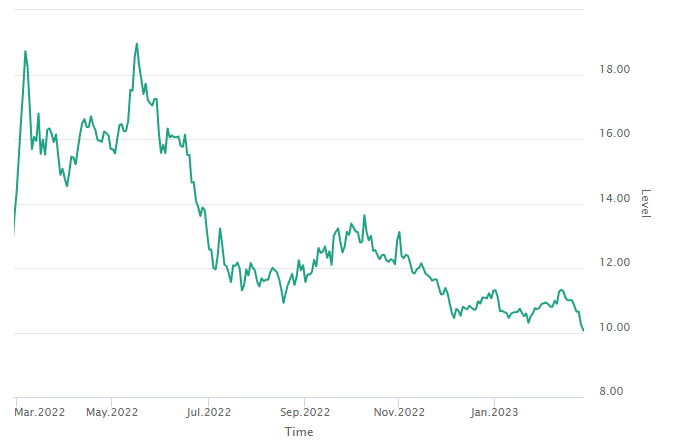

Volatility

Regarding the overall commodity volatility sector, it has not mirrored the volatility in the equity market despite the usual strong correlation between the two. The market nervousness displayed recently has caused both the VIX and VSTOXX to move back up above 20, but the impact on the commodity sector has been limited. It’s important to note that this could change quickly if there is a shift in market sentiment, especially if there is a significant correction in equities or any major geopolitical event.