Global Macro/Metals

G10 Central banks, including the FED, ECB, and BoE, have either slowed down or put an end to their hiking cycles due to expectations of a deceleration in inflation. This is driven by the belief that credit tightening measures are already sufficiently impacting the business environment, preventing the economy from overheating. The anticipation of a slower business environment has also curbed the pace of increased commodity consumption that was expected following the end of COVID-19 restrictions in China, which had put a lid on prices. Furthermore, the higher nominal rates environment has prompted a reduction in inventory levels that had been accumulating for years, making commodities more susceptible to shocks. As a result, the asset class has become less correlated within its different sectors, with short-term supply and demand dynamics playing a more significant role, creating a heightened level of uncertainty overall. Gold, which has benefited from this uncertainty, experienced slight gains during the month. While other base metals reflected the broader economic slowdown (Copper down 4% on the month), despite China’s expansion in April1, which marked the first positive growth in months.

Volatility

Volatility in the market has remained relatively stable, although the prevailing uncertainty has made investors nervous, particularly with regards to potential interest rate hikes by central banks, which could trigger a significant downturn in equities. Implied volatility has remained above historical volatility, albeit showing an overall decrease in volatility levels particularly in the petroleum market.

Energy

The petroleum complex is currently experiencing a two-way market trend, characterized by a slight downtrend amidst an overall very bullish fundamental based consensus forecast. Initially in April, prices rallied above $80 per barrel (WTI) following OPEC+'s surprising decision to cut production. However, the market’s lack of response to the production cut and concerns (demand stemming from US banking stress, China’s previous months industrial weakness, and global recession fears) have led to a 15% sell-off in the latter weeks of April. Although OPEC compliance is expected to continue, Russia may face challenges in even respecting the quotas due to difficulties in exporting oil and its increased production (above 11 mio barrel per day in the last few months) caused by the EU’s embargo, especially on refined products. In the natural gas market, cooler weather in the US, below the seasonal average, generated some bullish sentiment during the month. However, the market remains adequately supplied with high inventory levels, particularly in Europe reducing the export incentive that was seen last year.

Agriculture

The agricultural sector has witnessed significant divergences between soft commodities and grains. Wheat prices experienced a decline of approximately 10% as Ukraine’s large exports through the Black Sea corridor, known as the “Black Sea initiative”, weighed on international prices. Ukraine’s corn exports also contributed to the downward pressure on prices as they have little incentive to maintain stocks while the corridor remains open. On the other hand, sugar prices surged by 21% due to fears in India that the approval of additional exports would be halted, stemming from reduced sugar cane processing in the country. The market is now eagerly awaiting the Brazilian crop, which will not reach full swing for a few more months. Additionally, coffee prices saw a significant increase of 10% in April due to concerns over the crops in Brazil and Colombia.

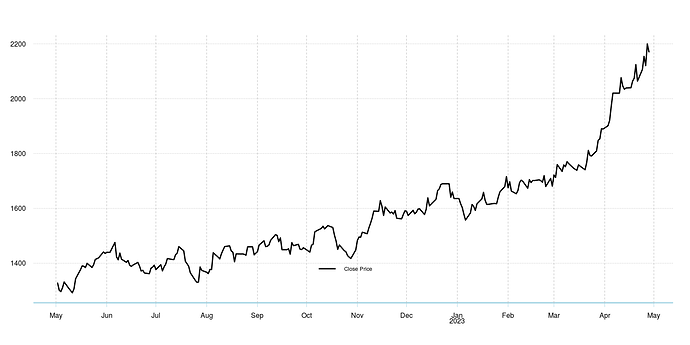

Sugar

1 Read our latest report to our proprietary index on Commodity Leading Index Economic Activity China